Achieved Rates Versus Asking Rates: The ECRI Impact

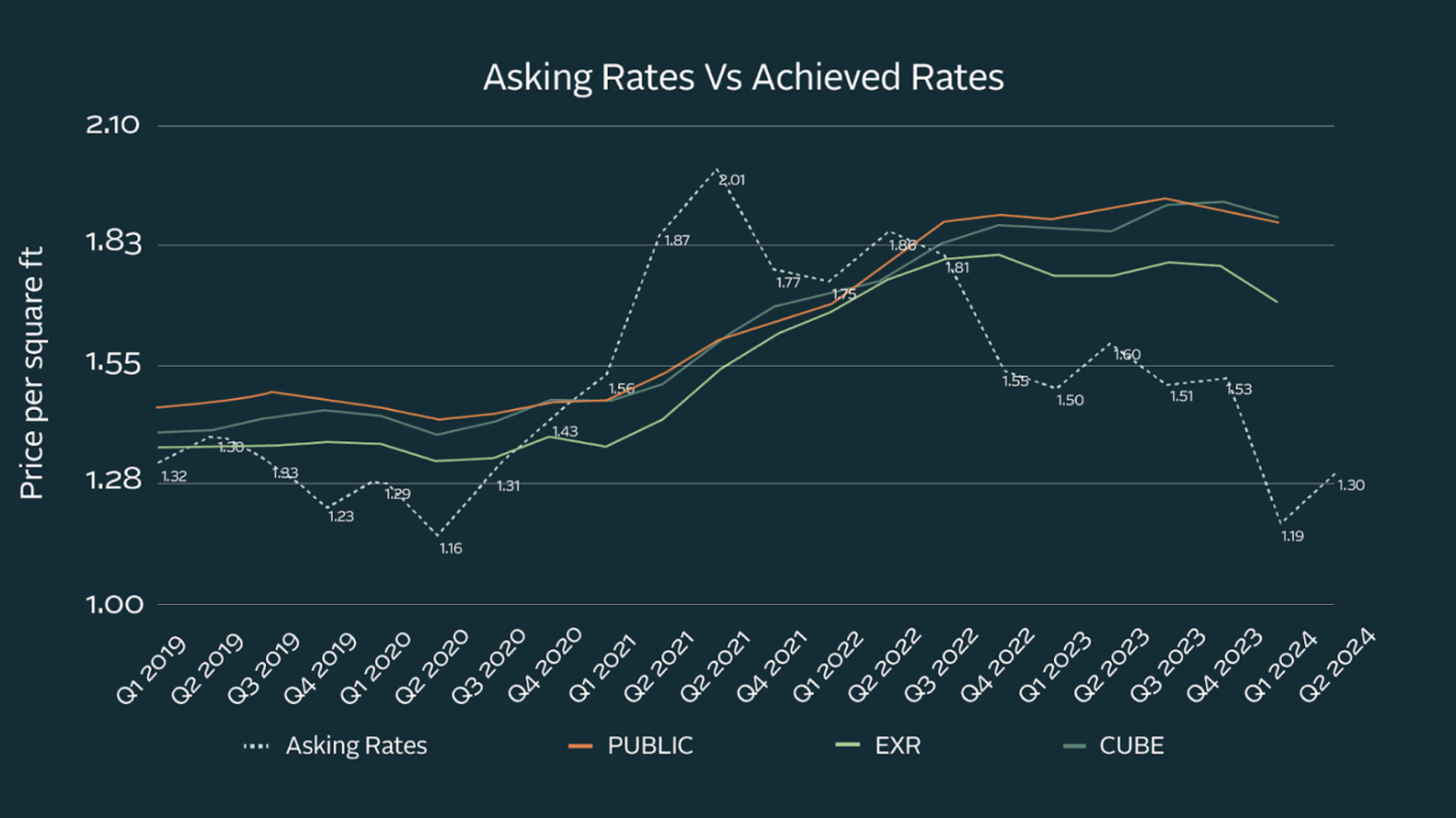

One of the most widely discussed topics in the industry right now is the large gap between asking rates being advertised by the REITs and the achieved rates their stores are producing. While asking rates have cooled off dramatically from 2021's all-time highs, we’re seeing that the achieved rates are still staying strong.

Q1 2019:

Asking Rates: $1.32

PUBLIC: $1.45

EXR: $1.36

CUBE: $1.40

Q1 2024:

Asking Rates: $1.19

PUBLIC: $1.88

EXR: $1.70

CUBE: $1.89

Analysis:

Asking Rates: -9.84%

PUBLIC: +29.67%

EXR: +25%

CUBE: +35%

It is great to see that in-place rates have continued to grow over time despite what is happening with asking rates lowering. This is driven by the REITs heavy use of aggressive ECRI’s (Existing Customer Rate Increases), in which a facility will advertise a lower price tag on a unit to drive occupancy, and then increase the cost of the unit at an accelerated rate than what we have previously seen with revenue management strategies in the past.

The outcome of this new revenue management strategy is still to be determined, but the effects of it on the industry have been made clear. Forecasting where rates will go in a market seems to be nearly impossible now, as the rates being advertised by REIT owned/operated facilities have become increasingly volatile. It is unclear to me if a facility that employs this aggressive ECRI model will stabilize its in-place rates within the 36-month timeline that is usually applied to Class A facilities, even if its physical occupancy is stabilized (85%+ physically occupied).

Will tenants be more likely to move out when getting their monthly fees increased at a higher velocity? Will they be less likely to rent a Self Storage unit in the future if they moved out because their rent increased? Or will there be minimal impact on the consumer and this becomes the new norm?

The REITs have demonstrated that they can drive revenue across their portfolio using this model but only time will tell whether this will be a sustainable practice.

Details on the data used:

- Top 25 Markets

- Unit sizes averaged: 5x5, 5x10, 10x10, 10x15, 10x20

- Companies: Public Storage, Extra Space Storage, CubeSmart

- Features: Climate Control AND Non Climate Control

- Price Type: Web

- Source: Radius+, and REIT Quarterly Earnings reports

James McLean is a market analyst for New York City-based Union Realtime, the developer of Radius+, a comprehensive site selection and location intelligence platform for self-storage.

James McLean is a market analyst for New York City-based Union Realtime, the developer of Radius+, a comprehensive site selection and location intelligence platform for self-storage. More Content

Popular Posts

The self storage industry is in a precarious...

Joe Shoen, CEO of U-Haul, has had enough.

Like its name implies, Surprise, Ariz., a...

Joe Shoen has had enough.

In a record-breaking deal finalized May 12,...

Senate Bill 709 (SB709) has many in the...

Donald Trump has just reclaimed the White...

The question of “abandonment” of stored...

Self-storage operators wear a lot of hats....

In 1992, Clinton strategist James Carville...

Recent Posts

When Neville Kennard left for a work trip to...

Self-storage software is no longer...

The self-storage industry continues to...

Fires in California. Tornadoes in Kansas....

From policy pivots in Ottawa to tariff...

Self-storage operators have struggled to...

Their signature red coats may draw attention...

Nailing down Josh and Melissa Huff for an...